C-end

CBDC Payment Services

1.The CBDC Wallet Matrix for IBDT

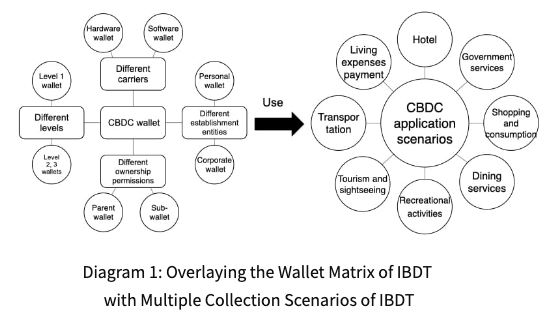

IBDT aims to achieve comprehensive online and offline applications of CBDC through the construction of a CBDC wallet ecosystem. This ecosystem is designed to meet the diverse needs of users in terms of multiple entities, multiple levels, multiple categories, and multiple forms, ensuring the inclusiveness of CBDC wallets and avoiding usability barriers caused by factors such as technological literacy or reliance on communication networks. Based on different dimensions, IBDT has designed four major types of CBDC wallets.

①According to the level of customer identity verification, the wallets are divided into different levels.

②Based on the issuer, the wallets are categorized as individual wallets and corporate wallets

③According to the medium, the wallets are classified as software wallets and hardware wallets.

④Based on the ownership of permissions, the wallets are categorized as parent wallets and sub-wallets.

CBDC wallet holders can designate the main wallet as the parent wallet and open multiple sub-wallets under it. Individuals can use sub-wallets to achieve functions such as limited payment in specific payment scenarios, conditional payments, and personal privacy protection.

IBDT's design of CBDC wallets across different dimensions forms the CBDC wallet matrix system. IBDT collaborates with central banks of various countries to develop basic payment function components and utilize smart contracts to enable conditional payments triggered by time conditions, scenario conditions, and role conditions.

2.CBDC Acquiring Scenarios of IBDT

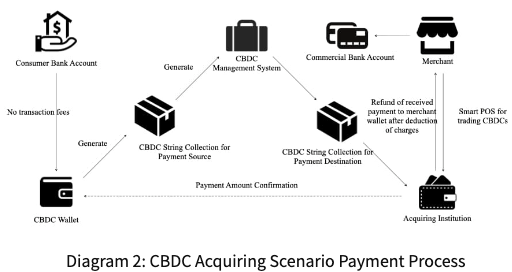

IBDT provides CBDC payment integration services for multiple acquiring scenarios, covering various payment scenarios including dining services, shopping, leisure and entertainment tourism, transportation, hotel accommodations, utility bill payments, government services and more. The CBDC wallet also enables "Dual Offline Payments," adapting to a wider range of usage scenarios for consumers.

CBDC Personal Consumer Credit Platform

1.Introduction to CBDC Personal Consumer Credit Platform

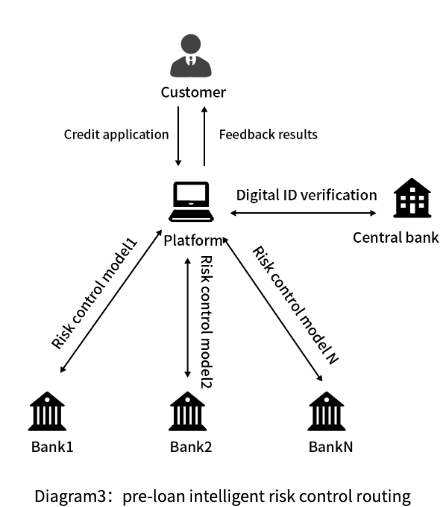

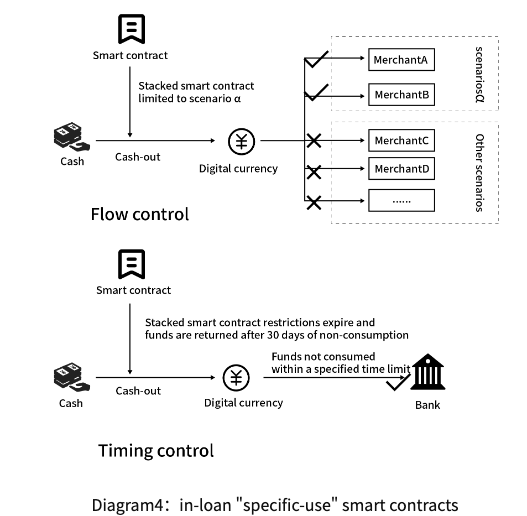

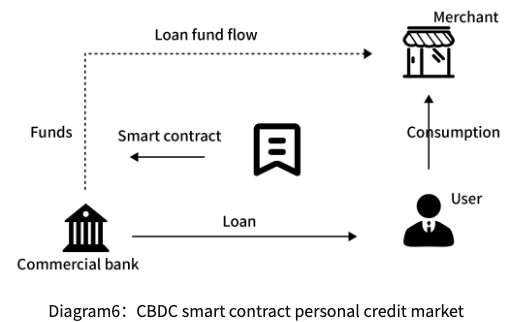

By employing pre-loan intelligent risk control routing and in-loan "specific-use" smart contracts, IBDT designs a digitalized personal consumer credit platform for CBDC. This platform achieves atomic-level fund management, reduces post-loan fund management costs for financial institutions, and enhances risk management capabilities.

The platform offers customized standardized interfaces and integrates with multiple commercial banks, thereby avoiding redundant development and enabling rapid iteration of new products.

By overlaying smart contracts on a coin chain or CBDC wallet, the platform supports predefined fund flows and timing controls, facilitating directed fund usage and automatic recovery upon maturity.

2.A comparison between the traditional credit card market and the CBDC smart contract personal credit market:

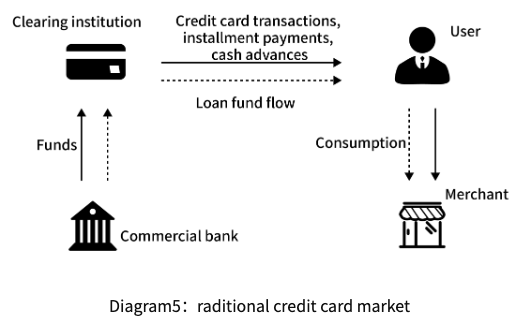

①The traditional credit card market

Characteristics of the traditional credit card market built on clearing institutions:

High Application Threshold:There are multiple application requirements, which limits the inclusiveness of the market.

High Borrowing Costs:Funds borrowed from credit cards generally come with high interest rates and fees, resulting in higher borrowing costs across different scenarios.

High Default Rates: After cash withdrawal from credit cards, users have limited control over the direction of funds, leading to a higher risk of defaults and bad debts.

②The CBDC smart contract personal credit market

Characteristics of the CBDC smart contract personal credit platform built by IBDT:

Improved Financial Accessibility: Reduces credit barriers, covers all users, and enhances market vitality.

Lower Borrowing Costs:Streamlines the process by reducing intermediary steps,improving efficiency, and lowering interest and fee costs.

Enhanced Credit Evaluation:The features of smart contracts contribute to establishing a credit evaluation system.

Risk Control: Smart contract-based credit enables control over the direction of fund flow, supports small-scale and high-frequency borrowing and repayment, reduces the risk of bad debts for banks, and fundamentally stimulates the vitality of the personal credit market.

In the CBDC smart contract personal credit field, there is no longer a dependence on clearing institutions. The clearing process will be liberated, resulting in cost savings for transactions. CBDC smart contracts bring significant innovative driving force to the consumer-side personal credit market, unleashing a substantial demand in the personal credit market, and stimulating its vitality.